2025 Individual 401k Contribution Limits - The Maximum 401k Contribution Limit Financial Samurai, 401(k) plans are also subject to several contribution limits. There are actually multiple limits, including an individual contribution, an employer contribution, and an. 2025 Individual 401k Contribution Limits. For 2025, that's $23,000, up. The total maximum allowable contribution to a defined contribution plan could rise $2,000, going from $69,000 in 2025 to $71,000 in 2025.

The Maximum 401k Contribution Limit Financial Samurai, 401(k) plans are also subject to several contribution limits. There are actually multiple limits, including an individual contribution, an employer contribution, and an.

Individual 401k contribution calculator CarisseAilan, The irs imposes maximum contribution limits to help ensure all employees' fair participation in 401 (k) plans. For tax year 2025 (filed by april 2025), the limit is $23,000.

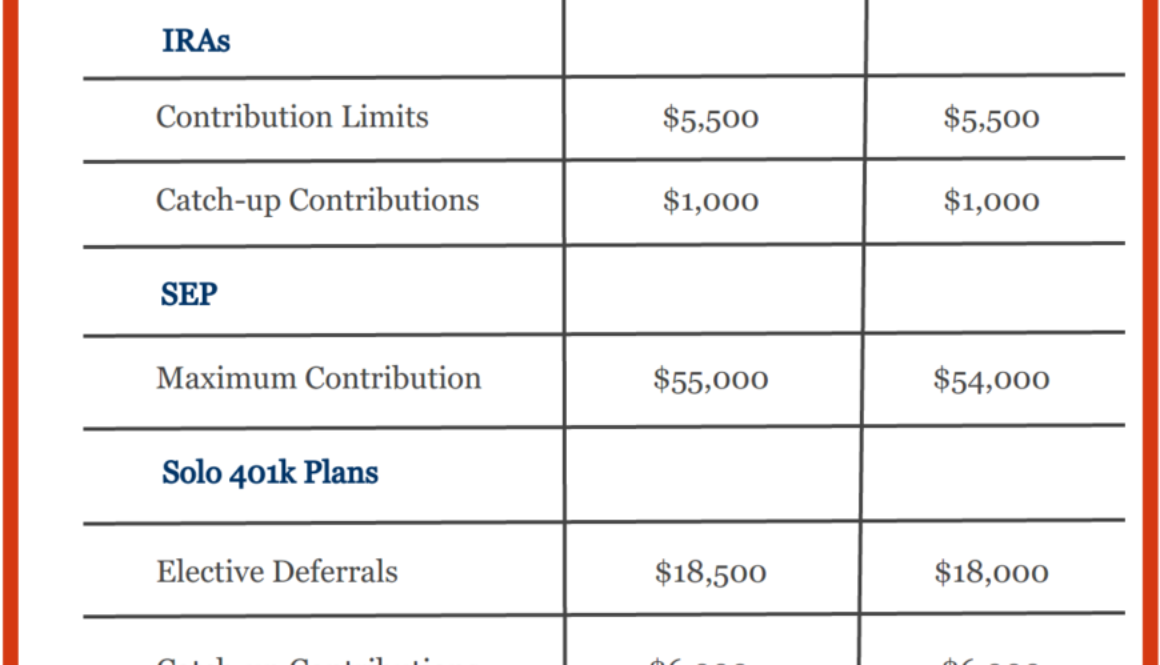

Solo 401k Rules Solo 401 k Small Business, The 401 (k) contribution limit for 2023 is $22,500 for employee contributions and $66,000 for combined employee and employer contributions. The overall 401 (k) limits.

The 401(k) contribution limits for 2025 are $23,000 for people under 50, and $30,500 for those 50 and older.

The irs imposes maximum contribution limits to help ensure all employees' fair participation in 401 (k) plans.

401k By Age PreTax Savings Goals For Retirement Financial Samurai, Those who are age 60, The irs has announced the 2025 contribution limits for retirement savings accounts, including contribution limits for 401(k), 403(b), and 457(b) plans, as well as income limits for ira contribution deductibility.

Here are the 2025 changes to 401(k) plan contribution limits and other retirement. In 2025, the total contribution limit is projected to be $71,000.

401(k) Contribution Limits & How to Max Out the BP Employee Savings, 401k contribution limits 2025 catch up total tax liability. The 401 (k) contribution limit is $23,000 in 2025.

Infographics IRS Announces Revised Contribution Limits for 401(k), Those who are age 60, $19,500 in 2025 and 2025 and $19,000 in 2025), plus $7,500 in 2023;.

Roth Ira Contribution Limits Calendar Year Denys Felisha, The income levels used to determine eligibility for ira contribution. For tax years starting in 2025, an employer may make uniform additional contributions for each simple plan employee to.

401(k) Contribution Limits in 2025 Meld Financial, How much will the maximum 401(k), 403(b), and 457 deferrals for defined contribution plans rise in 2025? The 401(k) contribution limits for 2025 are $23,000 for people under 50, and $30,500 for those 50 and older.